FUND

Accelerators

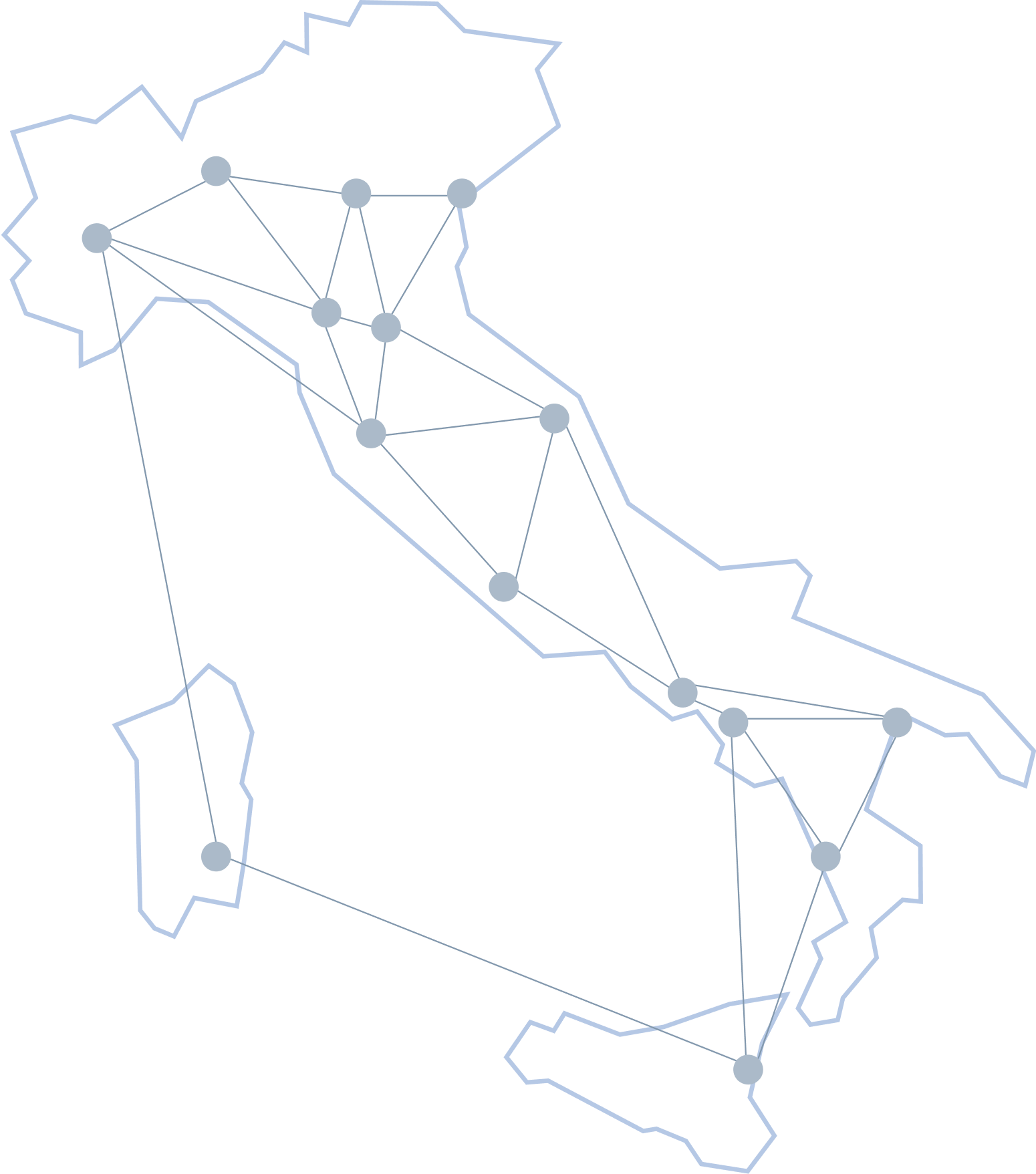

We invest in a National Network of Accelerators, a network of vertical programmes in strategic fields and technologies present throughout the country, in partnership with leading Italian and international operators and corporations in the relevant industries.

The Fund makes investments in the early stages of development (Pre-seed and Seed) through financial vehicles (Newco) and intervenes directly with investments in the later stage (Post-seed).

Consult Portfolio

We invest in companies that have passed the prototyping stage and need support to validate the business model and define the product-market fit.

We select the best ones from the accelerator programmes we work with and accompany them through the next stages of growth.

National Network Accelerator

Team

Faq

What are start-up accelerators?

Accelerators are key players in the venture capital ecosystem that invest in Pre-Seed and Seed start-ups that have already developed a Minimum Viable Product (MVP), helping them to validate the product-market fit and to access subsequent funding rounds through structured programmes that provide support, mentorship and financial resources

Of what is CDP Venture Capital National Accelerators Network composed?

CDP Venture Capital National Accelerators Network consists of 20 vertical accelerators, launched from 2020 onwards and spread nationwide. All acceleration programmes are developed in cooperation with leading Italian and international operators, with significant corporate participation. The sector focus ensures (i) specific expertise in the different fields, (ii) collaborations with leading companies in the sector and (iii) the involvement of institutional sponsors. This model makes it possible to effectively cover a wide range of sectors and programmes, facilitating the development of start-ups and their access to the market on a national and international scale

How can the CDP Venture Capital National Accelerators Network be accessed?

All of the Fund's Acceleration Programmes are divided into 3-4 batches, each aiming to accelerate around 8-10 start-ups. Interested start-ups can apply through the website of the accelerator, which, in addition to using its network of partners and affiliates to identify start-ups that meet the programme's requirements and objectives, launches a call for applications each year, collecting all the applications. During the initial phase, applications are screened to select around 20 start-ups to be taken to the final phase, from which 8-10 batch start-ups will be chosen. Once the selection is made, the acceleration programme begins, supporting start-ups in business development through workshops, mentorship, networking activities and structuring the subsequent fundraising. In addition to strategic support, the Fund's accelerators offer financial support, with an initial pre-seed investment in the range of €70,000-200,000 and the possibility of follow-on seed of around €200,000-500,000.

Which sectors does the Accelerator Fund invest in?

The Fund takes a vertical approach to individual programmes but a generalist one as an overall strategy, investing in high-tech companies active in the sectors for which each of the 20 accelerator programmes has been developed. These sectors correspond to the main areas of industry and technological innovation, including: automotive, aerospace, advanced mechanics, energy, food and agritech, fashion, circular economy and many others. In fact, the Fund's objective is to build an interconnected network of 20 vertical accelerator programmes, each focused on a specific sector and strategically distributed across the country.

Is support from the Accelerator Fund limited to the acceleration process?

No, in fact the Accelerator Fund adopts an indirect and direct investment strategy. Start-ups in the Fund's portfolio initially participate in one of the Network's 20 acceleration programmes, receiving a pre-seed ticket and, eventually, a follow-on seed through investment vehicles created for each programme. However, the Accelerator Fund can continue to support the most promising start-ups even after the acceleration process, through direct investments in Series A/B rounds with tickets in an indicative range of approximately €1-5 million