RegTech start-up Mopso closes 1 million euro seed round

The capital increase is aimed at the development of new product functions and expansion into the European market

Milan, 26 February 2025

RegTech start-up Mopso, active in anti-money laundering and the prevention of financial crimes, has closed a 1 million euro seed round.

The capital increase was subscribed by Apside, the 50/50 investment joint venture owned by Intesa Sanpaolo and Zest S.p.A., by Fin+Tech, the programme of the CDP Venture Capital National Accelerators Network dedicated to fintech and insurtech, with a follow-on investment and a further investment by Centro Istruttorie, a company belonging to the Moltiply Group. The round also saw the equity investments of a number of business angels.

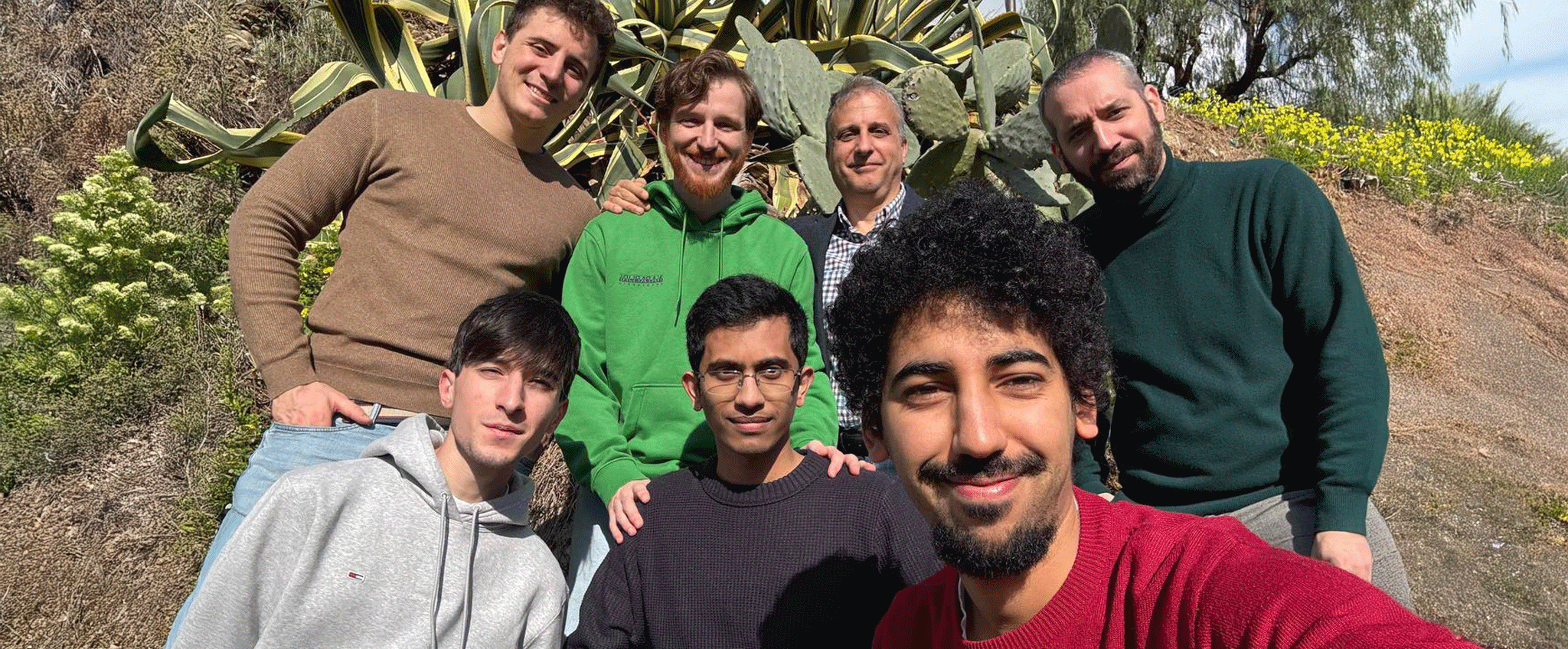

Mopso was established in Milan in 2021 based on the experience of the founders, a former Bank of Italy manager (Andrea Danielli) and a serial entrepreneur (Enrico Fagnoni), with the aim of offering banks and financiers a modular software platform for the prevention of money laundering. Mopso's products use the semantic web and digital identity to simplify compliance processes. More specifically, Brain identifies suspicious transactions and risky customers by integrating millions of pieces of information from internal sources enriched with datasets and Open Source Intelligence, while its algorithms perform risk profile searches and analyses of network connections. Amlet makes due diligence data “portable” and reusable within an ecosystem of intermediaries after translating them into verifiable credentials. This way onboarding procedures are simplified and prepared for the use of the European Digital Identity wallet.

Counting banks and AMCs among its clients, the start-up saw a turnover growth of 70% in 2024, also thanks to the development of new business lines. Mopso is also highly active in the field of research, last year winning a tender in Luxembourg for the PAMLA project, which involves the use of high-performance computing to rapidly train innovative machine learning algorithms.

“The quality and importance of our investors confirms the solid prospects of our project. We are already working to create the right commercial and industrial synergies, we hope to strengthen research and development with the support of strategic partners, and with the Moltiply Group galaxy we are already seeing many areas of concrete collaboration”, said Andrea Danielli, Mopso’s Chief Executive Officer.

“The investment in Mopso is fully consistent with Apside's strategy, one of whose primary objectives is to support technology solutions that improve the efficiency and security of the financial sector. The solutions developed by the start-up represent a step forward in automating compliance, simplifying due diligence processes and preventing risk in an increasingly complex regulatory environment”, observed Enrica David, Senior Director Shareholdings & Corporate Venture Capital at Intesa Sanpaolo and Chair of Apside's Investment Committee.

“Investing in RegTech AML solutions like the one developed by Mopso means supporting a safer, more efficient financial market, improving regulatory compliance. With increasingly stringent regulations, advanced technologies are essential to protect financial institutions and strengthen confidence in the system. We believe that innovation in this field is a strategic opportunity for the future of the industry”, added Gabriele Ronchini, Chief Executive Officer of Zest Investments and Vice Chair of Apside's Investment Committee.

“Mopso's solution, which works on automating compliance processes to detect suspicious transactions in real time, convinced us from the very first meeting during the selection process for the Fin+Tech Accelerator”, commented Stefano Molino, Senior Partner and Manager of CDP Venture Capital's Accelerator Fund. “Today we are very satisfied with this follow-on that has also involved other investors, a sign of the value of the process put in place with the Mopso team to make compliance faster, more automated, and more accurate”.

“Strategic support for the Italian and European financial ecosystem also stems from the continuous search for innovative solutions for critical processes with a high level of added value, making the most of excellent technological, operational and regulatory platforms. The adoption of advanced digital technologies, scalable infrastructure, systems for conscious data management and the use of tools to ensure transparency and traceability enable the creation of sustainable competitive value. MOPSO and Moltiply share and want to leverage the ambition of being able to propose innovation at the service of their customers, offering an integrated, dynamic ecosystem of digital services”, said Alessandro Fracassi, Chief Executive Officer of Moltiply Group Spa.

Conditional on certain turnover targets, the round will enable Mopso to increase its business abroad, entering some European countries, and to develop new features for its products.